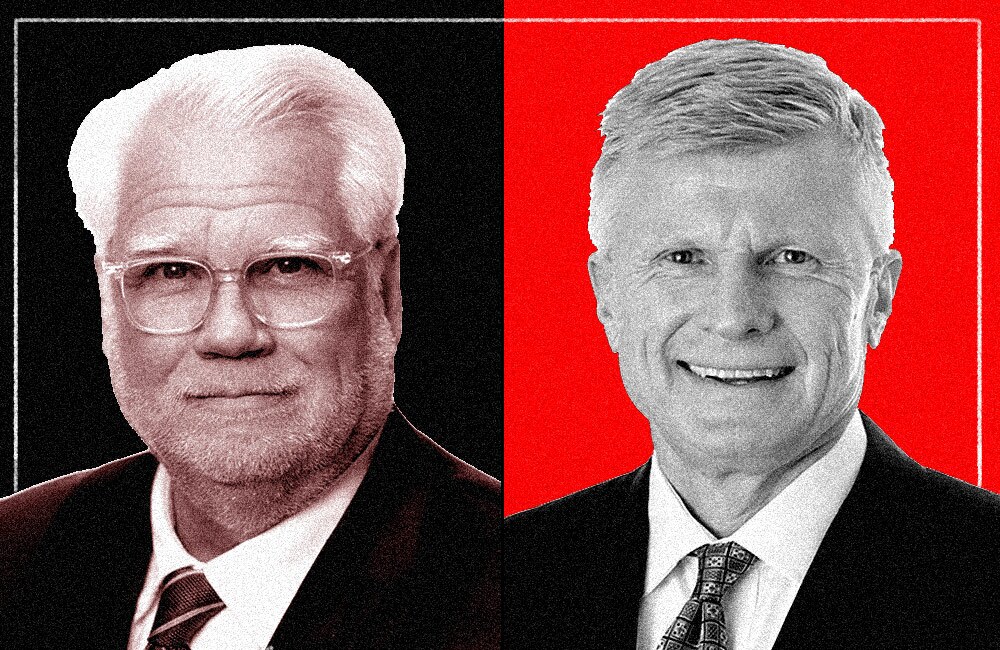

His RIA in Los Angeles was doing well. But when Mark Davis felt he was drifting from his partners in early 2009, he decided to start his own firm again. Then someone told him about Captrust.

Intrigued by the Raleigh, N.C.-based company, Davis called Captrust CEO Fielding Miller on a Sunday afternoon and became enamored by the private wealth manager, whose advisors, like him, primarily tended to corporate retirement plans. To this day, Davis has little interest in the operational tasks of entrepreneurship and admits to being a “lousy businessman” because of it. But Captrust promised to take care of those responsibilities, enabling Davis to spend more time with clients, and the RIA provided support he would have never gotten while running his own company.

After the call, Davis flew to Raleigh the following week to meet Miller and other executives in person. When he got back to L.A., he began a week of more serious due diligence, including a call with an advisor who recently joined the firm. Davis also asked his father-in-law, an “astute business person” and a former executive of IBM and Fidelity Investments, what he thought about the opportunity.

His advice? “Get as much stock as you can,” Davis recalled.

Within a month, Davis went from a stranger phoning to an employee of Captrust, where he has since worked for more than 10 years. “My only regret is I didn’t do it sooner. I look at my personal balance sheet and my single greatest asset is Captrust stock now.”

But Captrust courtships aren’t always that swift and not all stakeholders have benefitted like Davis.

Holding out on joining the RIA cost one advisor millions of dollars.

Daniel Esch first spoke to Miller in earnest about joining Captrust more than seven years before finally merging his $12 billion RIA in Minneapolis with Miller’s in 2014. Unlike other companies, Captrust was transparent about its financials in early discussions, Esch said. He was able to track its progress over time and when the decision became an easy one, he’d join.

Esch was patient. Years ago, many of the early deals Captrust did compensated sellers with 50% stock and 50% cash. Esch wanted only equity in exchange for DCAdvisors. In the relatively small universe of retirement plan advisors, competitors point to cash transactions and tell companies their advisor is preparing for retirement, won’t be around much longer, and should consider hiring them instead. The equity stake showed his commitment to Captrust and his clients.

“I wasn’t ready in 2006 or the early years of the courtship to really change my business and my structure. But I was also very cognizant that, as I entered a certain age group, that the valuation of my business was not going to increase. At some particular age, it would start to decrease, only in that competitors and so forth would start to weigh out the retirement day,” Esch said.

He also considered the growth trajectory of DCAdvisors and the opportunities for its employees if the RIA remained independent or folded into another.

After the seven-year deliberation, a deal with Captrust would finally satisfy Esch’s necessary criteria. But it wasn’t without cost. Between 2006 and 2014, Captrust’s assets continued to grow past $120 billion and the value of the company’s shares tripled. It now manages more than $290 billion.

As a result, Esch has missed out on millions of dollars and colleagues won’t let him live it down. “We’re merciless with him,” Davis said. Coworkers periodically play a game of “what if?” with Esch and his wife at company events.

“Dan ran a great company. He didn’t need to do anything different. He enjoyed those [entrepreneurial] parts and I think that’s why it took him a long time,” Davis said.

Choosy about who it welcomes, no one joins the company out of a position of weakness, which makes the decision hard for some, John Curry, the chief marketing officer at Captrust, said. He expects another advisor to join Captrust in 2020 that the company has been in talks with more than seven years.

If the new advisor is teased like Esch for not selling sooner, hopefully they also take it in good stride.

“I definitely made the right decision. The timing of it could have been perhaps a little earlier, but again, the stars needed to align for a lot of reasons, both professionally and personally. I think we got the formula right when it’s all been said and done. I’m happy.”