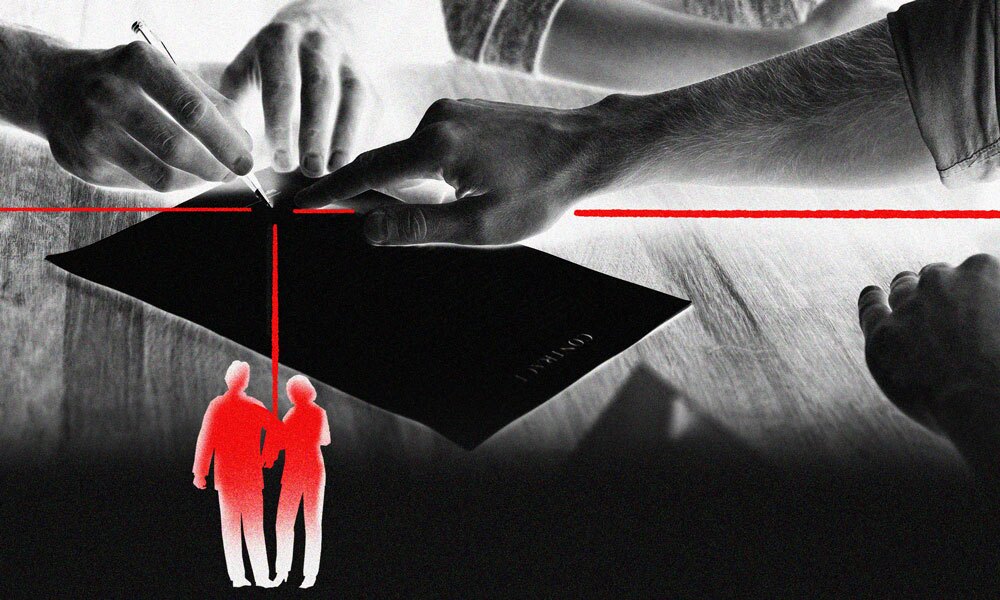

Older generations are expected to transfer $70 trillion to heirs and charities by 2042 and most of those assets will eventually have different managers, according to the latest analysis by Cerulli Associates, a Boston-based research and consulting firm.

More than 70% of heirs are likely to fire or change financial advisors after inheriting their parents’ wealth, according to Cerulli. (A similar percentage of women change financial advisors after the death of their spouse.)

“This disconnect can become a significant wrench in any estate, let alone for an advisor’s business continuity. Advisory practices that have not already done so will need to shift their mindset and strategically engage their clients’ spouses and children on a more regular basis,” Cerulli said.

With so many assets anticipated to slosh around in the coming decades, advisors should look to their own business to ensure they remain relevant to younger generations.

Wealth managers say many new clients are referrals from friends, family members, or existing clients. Others are people they have a personal relationship with, or are referred to them from accountants, attorneys, and other professionals. Contrary to what the volume of headlines about mergers and acquisitions might indicate, purchasing clients or another advisory business is not a source of new clients for more advisors, according to Cerulli.

But if that many new clients come from family and friends of existing ones, why can’t advisors keep inheritors as clients?

Cerulli says there is an increasing need for intergenerational planning and engagement and that more or better conversations “must be had at all levels of the family.” Baby boomers alone are expected to pass on a total of $51 trillion.

Tax and estate planning are a good way to engage both clients and their heirs but, on average, only 51% of advisors offer tax planning services, according to Cerulli.

Some wealth managers are counseling clients on taxes and estate planning more than others. Independent and hybrid RIAs offer those services at a higher rate than wirehouses and other wealth managers that are restricted by central home offices or “forced to couch communication pertaining to income taxes under the disclaimer that recommendations provided by the advisor should not be considered tax advice, if their firms determine that they have satisfied the legal and other requirements necessary to offer the service.”

RIAs also have the highest rates of CFP certification, which indicates an advisor has basic knowledge of core income tax planning concepts that they can apply to their clients, Cerulli said.

Perhaps that’s why the richest investors are increasingly choosing RIAs.

“The looming wealth transfer presents a significant opportunity for advisory firms that can adapt to a shifting landscape and evolving wealth demographic,” Cerulli analyst Chayce Horton said. “It remains critical for wealth management firms to have thorough discussions with clients and ensure they have well-designed and adaptable intergenerational plans in place.”